The U.S. Supreme Court issued a ruling in the South Dakota vs Wayfair case that opens the door for states to impose sales tax on sellers outside their borders. The case highlights a new standard of business presence called "economic nexus" that may …

Tax

Business Expenses – Do’s and Don’ts

Knowing whether you can or can't expense a purchase for business purposes can be complicated. However, there are a few hard-and-fast rules to help you. Listed below are some do's and don'ts that can help you identify your business …

Contractor or Employee

Contractor or Employee? Knowing the difference is important Is a worker an independent contractor or an employee? This seemingly simple question is often the contentious subject of IRS audits. As an employer, getting this wrong could cost you …

Five Home Office Deduction Mistakes

If you operate a business out of your home, you may be able to deduct a wide variety of expenses. These may include part of your rent or mortgage costs, insurance, utilities, repairs, maintenance, and cleaning costs related to the space you …

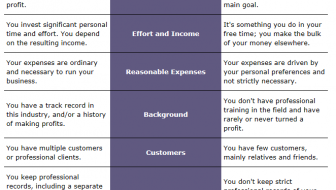

Business or Hobby?

When you incorrectly claim your favorite hobby as a small business, it's like waving a red flag that says "Audit Me!" to the IRS. However, there are tax benefits if you can correctly categorize your activity as a small business. Why does hobby …